When founders compare incubators vs accelerators, they quickly discover that both programs can help yet each unlocks value at different stages. Because incubators emphasize discovery and MVP formation, they suit early teams still validating a problem, shaping a solution, and assembling the company. Conversely, accelerators compress growth into focused sprints, which is ideal once an MVP exists and metrics must improve quickly. Consequently, the smartest choice depends on stage fit, cadence, and desired outcomes. Moreover, the following guide translates these differences into a practical decision playbook that protects runway, reduces dilution, and drives measurable progress.

Incubators vs Accelerators: What They Really Mean

Quick Take

- Incubator: A months‑long, mentor‑supported environment designed to move from problem discovery to MVP and early validation. Therefore, the cadence favors interviews, prototypes, pilots, and basic operational setup such as incorporation, equity splits, and light compliance. Additionally, capital may arrive as grants or small checks with little or no equity.

- Accelerator: A time‑boxed, high‑intensity program (8–16 weeks) that targets weekly KPIs, distribution, and fundraising readiness. Consequently, accepted startups usually have an MVP, early users, pilots, or revenue, and they plan to raise soon after graduation. Furthermore, equity and cash follow standardized terms and include alumni and investor networks.

Levers You Should Compare

Stage Served

Incubators support idea to pre‑MVP stages, team formation, and early operations; therefore, success looks like a working MVP and real signals of pull. Accelerators support MVP to early traction, repeatable growth, and investor readiness; consequently, success looks like metric lift, a clean data room, and strong partner or investor pipelines.

Time Horizon and Cadence

Incubators run three to twelve months with flexible pacing, while accelerators run eight to sixteen weeks with strict weekly sprints. Therefore, choose based on whether discovery cycles or execution sprints best serve the next milestone.

Capital and Equity

Incubators may provide grants or stipends and often require little or no equity. Accelerators provide standardized checks for a standard percentage. Consequently, always calculate the implied valuation and decide whether the network premium justifies the dilution.

Programming and Mentors

Incubators emphasize customer interviews, JTBD mapping, prototype design, basic GTM, and co‑founder matching. Accelerators emphasize growth loops, pricing experiments, sales process, hiring plans, and fundraising narrative. Moreover, operator‑mentors with relevant domain experience should meet you weekly in either model.

Network and Outcomes

Incubators offer local mentors, university ties, and early pilot channels; therefore, outcomes include MVP shipped, interview evidence, and initial pilots. Accelerators offer broad alumni and investor access; consequently, outcomes include measurable KPI lift, partner deals, and a strong post‑program fundraising pipeline.

Incubators vs Accelerators: A Decision Framework by Stage and Risk

Incubator is recommended when

- The top persona remains uncertain and willingness‑to‑pay is unproven.

- No MVP exists, or the team needs structured help to ship quickly.

- Co‑founder matching, equity splits, and incorporation still need attention.

- Discovery, prototyping, and pilot design will create more value than investor intros.

- Facilities (labs, hardware, or specialized equipment) and grants would accelerate progress.

Accelerator is recommended when

- An MVP exists and early users, pilots, or revenue show real signal.

- The team can commit full‑time and report weekly KPIs without excuses.

- Growth, retention, and revenue will improve with focused coaching and partner access.

- Fundraising is planned within three to six months.

- The program’s network directly matches your motion—PLG, enterprise, marketplace, or deep‑tech commercialization.

Choose a Hybrid Path When

- Some workstreams require long discovery cycles while others can scale now.

- A public or university incubator offers low‑dilution support, and a later accelerator can amplify GTM.

- The founding team prefers to de‑risk science or compliance first and then accelerate sales.

Incubators vs Accelerators: Equity Math and Dilution

Calculate Implied Valuation

- Implied post‑money = Investment / Equity %.

- Example: $150k for 6% implies $2.5M post‑money. Therefore, decide if the program can realistically help you raise faster and on better terms.

Compare Scenarios

- Scenario A: Join now and accelerate.

- Scenario B: Bootstrap another quarter and raise at a higher valuation.

Consequently, compare not just headline valuation but also expected uplift: speed to PMF, metric improvement, and fundraising quality.

Network Premium vs. Paper Terms

A famous brand helps, yet only outcomes pay the bills. Therefore, ask for hard metrics: alumni follow‑on quality, survival rates, sector wins, and post‑program support depth.

What Success Looks Like—Before You Sign Anything

Incubator Success (3–12 Months)

- Crisp problem statement and prioritized personas with quantified pain.

- MVP shipped; 15–30+ deep interviews; pilots, waitlist, or LOIs.

- A basic GTM hypothesis and a pricing test plan.

- A data‑driven decision to pivot, proceed, or pause—with reasons.

Accelerator Success (8–16 Weeks)

- North‑star metric moving (e.g., ≥15–25% MoM growth or retention lift).

- Repeatable acquisition and/or sales motions documented.

- Fundraising readiness: narrative, milestones, data room, and target investor list.

- Strategic relationships: investors, channel partners, and anchor customers.

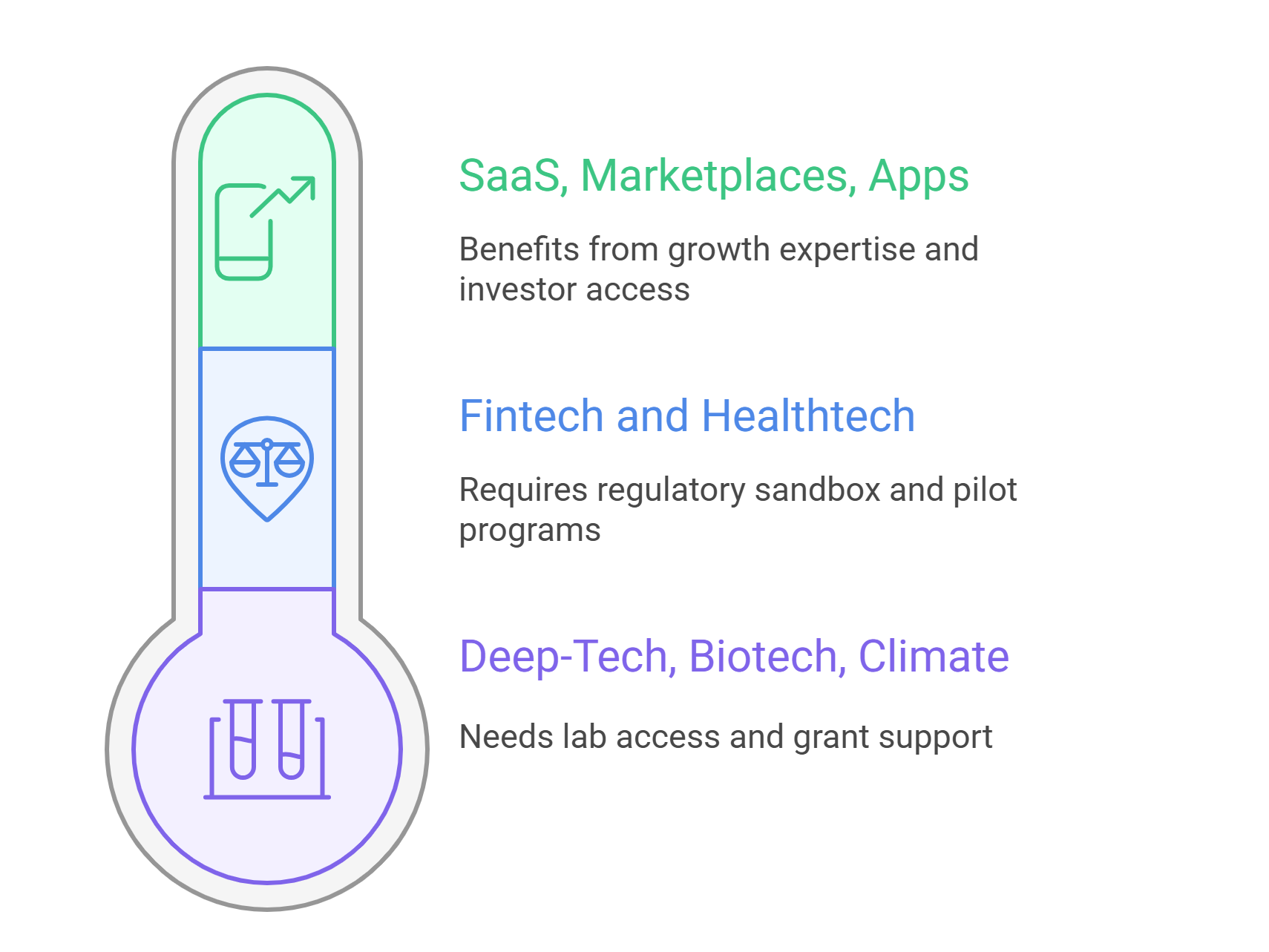

Sector Nuance: How Incubators vs Accelerators Vary by Industry

Deep‑Tech, Biotech, and Climate

Long R&D and regulatory paths favor incubators with labs and grant support; subsequently, accelerators help with commercialization, supply chain, and fundraising.

Fintech and Healthtech

Compliance and integrations slow early motion; therefore, incubators help navigate regulatory sandboxes and pilots. Later, accelerators boost distribution and credibility with institutions.

SaaS, Marketplaces, and Consumer Apps

Once an MVP shows retention, accelerators add growth expertise, pricing experiments, and investor access; consequently, time to seed or Series A compresses.

Case Study

Background

A two‑founder team offered a data‑integration platform for mid‑market enterprise IT. Because discovery identified the right user persona yet budget authority remained unclear, pilots stalled. Moreover, sales cycles stretched beyond three months, and the “build vs buy” objection slowed decisions.

Program Choice

The team compared incubators vs accelerators and chose an accelerator, since the product already worked and pilots existed. Therefore, they prioritized growth experiments, enterprise sales coaching, and investor readiness.

Execution

- Week 1–2: They defined a north‑star (sales cycle length) and guardrails (pilot activation, mid‑funnel conversion). Additionally, they reframed ROI in the language of incumbent tools and segmented targets by integration complexity.

- Week 3–6: They standardized discovery scripts, tested platform‑fee plus usage pricing, and built two vertical narratives. Furthermore, they created a one‑page pilot outline that nailed success criteria and staffing.

- Week 7–10: They developed a “build vs buy” calculator, lined up three alumni champions, and replaced cold outreach with intros via the program’s network. Consequently, pilot throughput increased and decision speed improved.

- Week 11–12: They finalized the fundraising narrative, assembled a clean data room, and scheduled partner meetings; moreover, they defined post‑fund milestones and first hires.

Results

The average sales cycle dropped from 118 to 57 days. Pilot activation rose 40%. First‑year ACV increased 18% due to clearer packaging. Because unit economics and repeatability looked credible, two leads offered term sheets. Consequently, the company closed a seed round on better terms while keeping focus on its enterprise wedge.

30‑Day Self‑Assessment Before You Apply

Week 1: Customer Discovery

Interview 10–15 ideal users; quantify pain frequency and alternatives. Rank use cases by urgency and capture willingness‑to‑pay. Consequently, write three crisp hypotheses.

Week 2: MVP and Promise

Define the smallest viable promise. Ship a lean MVP (no‑code where possible) or a simulation for regulated markets. Additionally, draft a one‑page pilot outline and a simple pricing test.

Week 3: Launch and Measure

Recruit a small cohort; measure activation and first‑week retention. Instrument a north‑star plus two guardrails and simplify the path to first value.

Week 4: Decide Your Path

If validation is weak, choose an incubator to refine problem, persona, and prototype. If validation is strong, choose an accelerator to systematize growth and prepare to raise.

Execution Playbooks Inside Each Program

Inside an Incubator

Set weekly discovery quotas, prototype milestones, and public check‑ins. Use mentor time to test assumptions rather than collect opinions. Leverage labs, credits, and grants. Therefore, exit with evidence: MVP shipped, interviews logged, pilots committed, and a go/no‑go decision.

Inside an Accelerator

Baseline metrics before day one and set weekly targets that compound toward demo day. Build a lightweight growth‑ops stack (analytics, CRM, attribution, collateral). Treat mentor sessions as experiments with hypotheses and results. Prepare the data room by week two and start soft diligence by week four.

Fundraising Readiness: What Investors Expect

Narrative and Metrics

Explain “why now,” your wedge, and your unfair insight on one page. Show cohorts, activation, retention, payback, and pipeline health.

Milestones and Use of Funds

Show what 12–18 months of runway buys and how those milestones unlock a step‑change in value. Consequently, tie budget to measurable targets.

Team, Risks, and Proof

Identify owners for product, growth, and sales; list immediate hires; and disclose top risks with mitigations. Add paying‑user references or credible pilots.

ROI: Did the Program Earn Its Equity?

Equity vs. Uplift

Did equity translate into faster PMF, faster growth, or a better round? Otherwise, the same milestones might have been reachable without dilution.

Counterfactual Speed

Would you have reached the same outcomes on your own timeline? If not, the network and cadence likely added real value.

Long‑Tail Value

Six to twelve months later, do alumni channels, partner deals, and mentor access still produce lift? If yes, the compounding may justify the initial cost.

Actionable Summary

- If discovery is fuzzy and no MVP exists, select an incubator and set a 90‑day plan to ship, interview, and secure pilots.

- If an MVP exists and signals appear, select an accelerator and commit to weekly KPIs, partner intros, and investor prep.

- If different workstreams require different cadences, choose a hybrid path that incubates hard science and accelerates go‑to‑market.

- In all cases, protect equity, insist on operator‑mentors, measure weekly, and publish outcomes to stakeholders.

Frequently Asked Questions

Can a solo founder go straight to an accelerator?

Sometimes, although incubators often help with co‑founder matching and early discovery. Therefore, if the MVP is weak or the problem is fuzzy, choose the incubator first.

Do all incubators take equity?

No. Many public or university incubators use grants or nominal fees. However, confirm IP terms, mentor access, and the speed of decision‑making.

Will an accelerator accept pre‑revenue startups?

Yes, if there is strong signal—active usage, retention, enterprise pilots, or credible technical milestones. Consequently, show pull, not just activity.

Should I ever do both?

Yes. Many teams incubate to MVP and then accelerate to scale and raise. Therefore, the sequence—first discovery, then growth—often maximizes value.